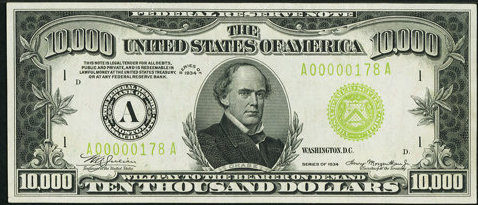

Several recent high-profile articles in publications including The New York Times have predicted a quick end to cash. They argue that between credit cards and electronic payment systems like Zelle and Venmo that we are well on our way to becoming a cashless society. We are here to question that narrative and look at the reality of the need for cash in our society, and the ultimate conclusion that cash won’t be going anywhere anytime soon.

Cash and the Pandemic

As the owner of an ATM company I obviously have a vested interest in the outcome, but I also have an inside look at the use of cash and don’t see it disappearing anytime soon. Despite the rise of contactless payments due to the fear of contracting COVID-19 from cash, and many hospitality locations that were closed or running at less than full capacity, our Company’s total cash withdrawals for July 2020 across 1000 locations nationwide were an all-time monthly record.

Cash and the Big Banks

While the Big Banks would like to eliminate cash entirely because it would allow them to reduce staff, that is not currently practical. The bottom third of households in the U.S. are considered “unbanked” or “underbanked” and while they may have a checking account, they do not own a credit card. Part of the problem is bank fees, which penalize their low or unsteady income with fees and account closures.

Cash and Privacy

In addition, there are large numbers of Americans that prefer cash to electronic payments for reasons of privacy, both from government scrutiny and internet thieves. And credit card companies haven’t found a way to fully penetrate two large industries: gambling (including state lotteries) and recreational marijuana retailers.

Cash and Credit Card Fees

Not often mentioned in the argument for or against a cashless society is the high cost of merchant processing. Until someone figures out a way to lower the cost of credit card processing from the current 3 to 4% of the sale price, this expense will remain a major factor in the continued use of cash. No one wants to pay the 3 to 4%, not merchants, and not consumers when they are faced with new cash discounting systems.

Credit card fees are one of the top expenses for retail stores that sell small-ticket items like ice cream, and a major headache for retailers like beauty salons that use contract employees that receive credit card tips.

Cash Isn’t Going Anywhere!

As the owner of an ATM company, I don’t see cash going away. Too many Americans depend upon cash and too many others are skeptical of being controlled by Big Banks and Big Government.

Capitalizing on Cash as a Business Owner

After working firsthand with small businesses dealing with all forms of currency for over 20 years, I can unequivocally say that ATMs are the first way business owners should capitalize on the popularity and benefits of cash. Owning an ATM eliminates the need for merchant fees and makes business easier for your client base. When you purchase an ATM from New York ATM, we provide all maintenance services and repairs free of charge. For more information on purchasing an ATM, contact Jon today! 917-842-6201